It is not uncommon for builders to go bust, especially in the current building climate. We have seen this reality play out quite recently with Planbuild Homes. Though builder bankruptcy can be a highly stressful and sometimes costly experience, there are organisations and resources that you can turn to for help.

Understanding the situation

We will be focusing on builder bankruptcy in the state of Queensland, and how you can work with the Queensland Building and Construction Commission (QBCC) for a resolution. It is important to note that legislation, rights and responsible parties differ across the country, so you may need to check the rules in your state for mandatory builder insurance.

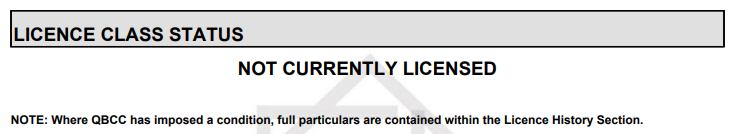

Liquidation or voluntary administration is a serious state of insolvency for any company. It usually signals the end of the company’s life after bankruptcy. When a building company goes into builder bankruptcy, their QBCC licence is revoked. All building works must stop immediately and the majority of staff are dismissed. An appointed administrator or liquidator takes control of the company.

Knowing your builder’s position

So, how do you know if your builder is going bust? If you are unsure what to look for, Buildi has listed 6 signs that your builder is facing bankruptcy, which is a great place to start.

In the case of Planbuild Homes, clients were reportedly told that the company was “going out of business.” Staff were sent home and offices remained closed, prompting homeowners to contact the QBCC for assistance.

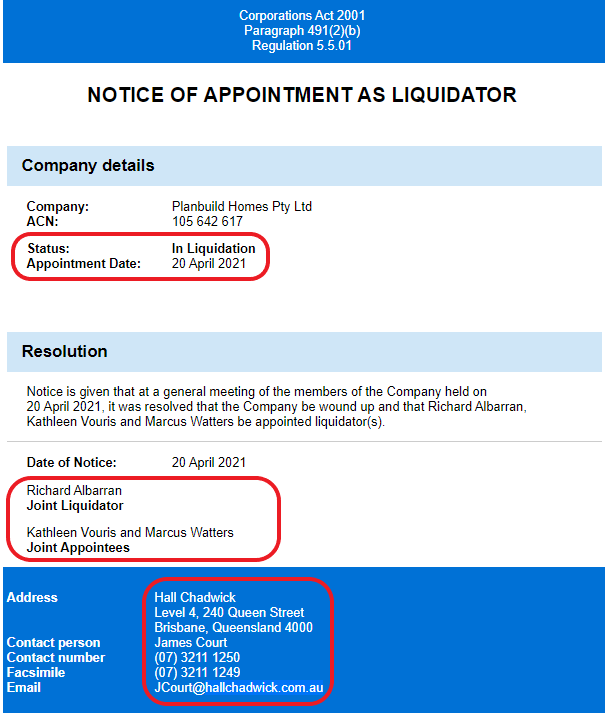

There are official announcements you can check, such as those issued by the Australian Securities and Investment Commission (ASIC). The ASIC website allows you to search for businesses and check for notices.

An ASIC notice includes the date of the decision, the details of the liquidators and their contact information:

In addition, you can look up any builder’s QBCC licence. We have detailed instructions on how to find a licensee and read through their history. Is the license still in effect, or has it been revoked? These are clear red flags to consider.

Whether you are in the middle of a build, or looking to start with a particular builder, ensure you do your homework. Check on the builder’s history, reputation and current business standing to ensure they will look after you from start to foreseeable finish.

Or, you can turn to Buildi.

We do the due diligence for you — we vet builders against strict criteria.

Where do I start?

As a home owner, the prospect of builder bankruptcy is highly stressful. Whether your home is near completion or it’s barely a slab, it can be tough to see your dream home or your investment come to a standstill. So if you are in this position, where do you start? What can you do?

Seek legal advice

The first step is to get some advice. Avoid making any decisions until you have spoken with someone who can help. A residential building and construction lawyer can look through your contract and discuss your options. You do not have to terminate your contract — and in some cases, it is advisable not to — on the basis of builder insolvency alone.

Contact the liquidators

You should make contact with the liquidator, who might be able to provide you with a solution and additional advice. Remember that you can find the liquidator’s contact details on the ASIC notice, as well as in the news and any communications issued to the company’s clients.

Reach out to a broker

You can also reach out to us. Here at Buildi, we intervene and work as your advocate in all stages of your build. If your home has stalled due to builder bankruptcy, we can help to guide you out of the confusion and back on track.

QBCC’s Home Warranty Scheme

Here’s where we get to the most important part. Builder bankruptcy in Queensland goes through the QBCC because they are the state construction regulators. They are able to sort out disputes, warranties and matters of insurance. Their Home Warranty Scheme is designed to protect you from situations where a builder is no longer able to complete work on your home.

There are two kinds of claims under the Scheme: non-completion or stopped work on your home, and a failure to fix defective work after the build. Read through the scheme’s Product Disclosure to familiarise yourself with your rights, any limitations and the extent of cover provided. Let’s look at some key points.

Non-completion claims

Non-completion essentially means that the work is unfinished and the contractor or builder has failed to fulfil their end of the bargain. This is your best option if builder bankruptcy occurs while your house is under construction.

To lodge a claim of this kind, you must have signed a fixed price contract for the home. It is also expected that the contract has ended because the builder has gone bankrupt (thereby cancelling their building licence). There are also some cost and time limits which can be found in the disclosure statement.

Who is eligible?

The following parties can apply for a non-completion claim:

- Property owner

- Body corporate

- Authorised agent

What sort of cover to expect

- If construction on your home has not started, the QBCC will refund your deposit paid to the builder

- If construction has started, the QBCC will pay for the difference between your initial finance and the actual cost to finish the project

- You may be able to claim accommodation expenses while construction is completed

How lodge a non-completion claim

First, you will need to supply some mandatory documents. These include:

- Evidence of contract termination or builder liquidation

- Building contract including all terms and conditions, and any contract specifications

- Council development, building approval and building plans if applicable

- Contract variation documents

- Receipts or evidence of payments made to the contractor

- It may also be useful to have evidence of site work not having commenced if making a claim for refund of deposit

You will then need to fill out and submit a Non-Completion Claim Form for Residential Construction Work.

Most of the form is relatively straightforward, but there are some questions to be aware of. You may need to plan ahead and get this information ready, such as:

- Owner/claimant’s GST details for the building site

- Real Property Description details (found on your rates notice or your Certificate of Title)

- The contractor/builder’s QBCC licence number and ABN/ACN (look up their name on the QBCC licence search)

- For an unfinished home, you will need to know the building stage the property is at (such as base, frame, enclosed or fixing stage), the stop date and payments made

Defective work claims

In this case, defects refer to structural issues (such as movement in the foundation) or water leaks. Defects also include cosmetic and non-structural issues. This claim usually applies when construction is complete or at least started, but defects are unresolved. There are specific time limits and exclusions that apply depending on the defect, which you can read more about here.

To lodge this sort of claim, ordinarily you must first contact the builder or contractor and allow them time to resolve the issue. Sometimes, the QBCC will require you to go through dispute resolution before processing a claim. Of course, in the case of builder bankruptcy, this is not possible and not required because the builder cannot carry out further work.

Who is eligible?

The following persons may apply for a defective work claim:

- The property owner

- Owner/occupier next door

- Body corporate

- Authorised agent

What sort of cover to expect

The QBCC pays for fixes in the residence or other buildings on the site. And, like non-completion claims, you may be able to claim accommodation expenses while work is carried out. Of course, this only counts if your home becomes uninhabitable in the meantime.

Defect cover includes the following, so long as they are attached to the building or residence:

- Anything that requires building or plumbing approval

- A verandah or deck

- Stairs or a ramp providing access to these buildings

- Work to support these buildings (e.g. replacing stumps)

- They also pay to rectify defects in the erection, construction or installation of a swimming pool

The following is not covered under this claim:

- Scaffolding, curtains, blinds, internal shutters, carpets, floating floors, vinyl, landscaping, insulation and insect screens

- Electrical appliances, phone or data cables and fire alarm systems

- Cubbyhouses, doghouses and shade sails

- Water meter or water tank not used for primary water supply

How to lodge a defective work claim

You will need to have the following documents ready for defective work:

- Contract for the work

- Final certification or practical completion/handover documentation

- Issues of subsidence require substantially more paperwork, which you can see on page 3 of this document.

Then submit the Complaints By Property Owner – Residential And Commercial Construction Work form.

Similar to the other form, there are some questions to be aware of. You may need to plan ahead and get this information ready, such as:

- Real Property Description details (found on your rates notice or your Certificate of Title)

- The contractor/builder’s QBCC licence number and ABN/ACN (look up their name on the QBCC licence search)

- The building stage the property is at (such as base, frame, enclosed or fixing stage), payment amounts and dates, and contract dates

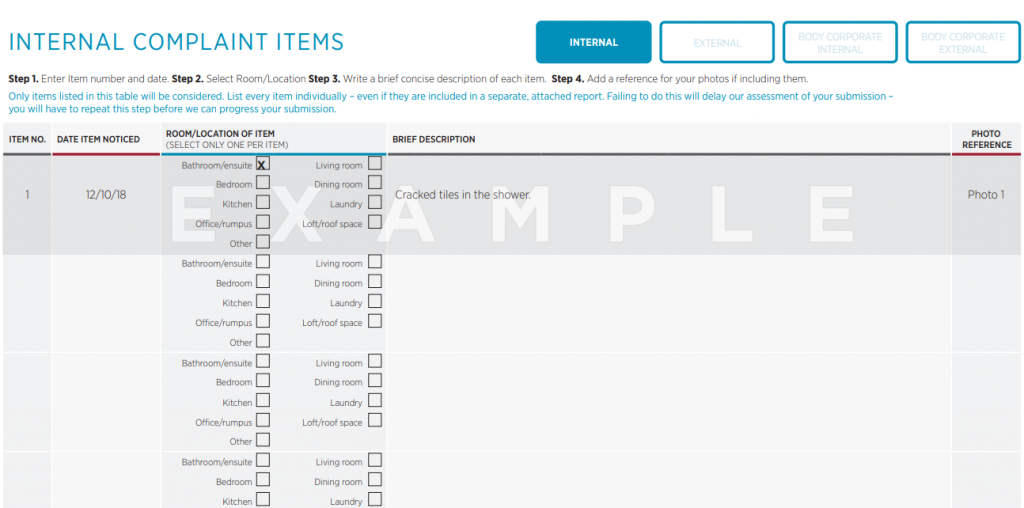

You will also need to complete a full list of complaint items. This must be done on the form itself.

Summary

We know that this process can be confusing and stressful. To put it simply, the QBCC says it best:

- If work hasn’t started, they may reimburse the deposit paid under the contract. Use this form.

- If work has started, they may cover additional completion costs including the repair of any defective work. Use this form.

- If work has finished, they may pay to rectify defects. Use this form.

Remember that you do not need to navigate this situation on your own. If your builder has gone into liquidation and you need advice, or would like to speak with an industry professional, give us a ring.

0 Comments