Being a first time home buyer in Queensland can be daunting. Whether you’ve been looking for a while or want to break out of the rental market and get a place to call your own. There are many factors to consider, how can you get the best house for my money? What help does the government offer to first home buyers? What are some ways you can save money during the process?

We’re here to help guide you through the process of getting your first home without getting ripped off. As well as other strategies to save that you might not have considered.

Renting vs Buying ?

Most people entering the property market for the first time come from a background of renting. While renting has its benefits there eventually comes a time where you get sick of the place you live being a never-ending expense. As well as a moneymaker for someone else. While attaining your first home is a significant financial investment; the second you attain land it becomes a vessel for capital growth.

The value of a home is more than the sum of its parts. A completed house build will almost always be valued higher than the cost of the land and construction combined. This means your new home has already started making your capital grow when it’s complete.

The cost of homes is only going up as Brisbane becomes more populated. Areas, where it may have once been affordable to purchase property, can quickly increase in value over just a number of years. If you pick the right area to buy you will watch your home’s value increase the longer you live in it. But more on that later.

Capital Growth vs Accumulative Expense ?

Owning your home ?

No more rent, every dollar you spend on your home adds to its value.

The longer you own the home the higher the value becomes.

It’s your home forever.

Customise your home however you like. Feel like repainting a room one weekend? You can!

Tax benifits, when owning a home you may be eligible for tax deductions on your mortgage or property taxes

Renting a home ?

Money spent on rent goes into someone elses pocket and you’ll have nothing to show for it in the end.

The longer you rent the higher rent becomes and you see no return on the money you will spend.

Lease contract deadlines make you feel uncertain about where you live.

Cant customise your home at all without the approval of your landlord.

No tax benifits at all for rental payments.

In short capital growth is the opposite of renting. The longer you own a home the more it will be worth when the time comes to sell.

What grants are avalible for first home buyers in QLD? ?

In Queensland first home buyers are eligible for financial assistance in a few ways. Firstly there’s the First Home Owners Grant that offers those building their first home $15,000. There’s also the first home vacant land concession that assists with reduces the cost of stamp duty when buying land saving you up to $7,175.

First Home Owners Grant (FHOG)

Is the First Home Owners Grant still available in QLD 2021

YES! The Queensland government offers first-time homeowners a $15,000 grant to help you get moved into your first property.

This is different from the recent HomeBuilder Grant that was introduced last year as a way to assist with Covid-19, that grant stopped taking applications back in April.

You can only get the First Home Owners Grant if your building a new home.

- Although the name suggests its a grant for anyone buying their first home… the first home owners grant is only for those building a new home

- A new home is defined as a place that has not be previously occupied or sold as a place of residence.

- The grant is avalible for any new home build that is valued under $750,000

First Home Owners Grant Eligibility

There are certain criteria you need to meet to be eligible

- You or your spouse cant have owned residential property in Australia.

- Must be over 18.

- You must be a Australian citizen or preminant resident.

- You must move into the home within a year of it being constructed

- You must live in it for at least 6 months

- The construction has to have be build in an out of arms reach contract.

- The property must be valued under $750,000. This includes the both land and construction.

Can you use the First Homes Owners Grant for your deposit

Yes! The First Home Owners Grant can be used as a deposit for the building of your home. Unfortunately, you can’t use it for a deposit to buy your land though so you’ll need to secure that money first.

How long does FHOG take to be paid?

That depends on how you chose to apply for FHOD. If you applied through a lending institute or bank, payment will be received on the first drawdown of funds. If you apply directly with the Office of State Revenue the grant will be paid when you have received your final inspection certificate.

How does the First Homes Owners Grant get paid

You can nominate any of your personal bank accounts to receive the grant or have it directly paid to your lender.

Want to know more about builder? Read our ultimate guide to Brisbane Builders Here

How to Save on Stamp Duty ?

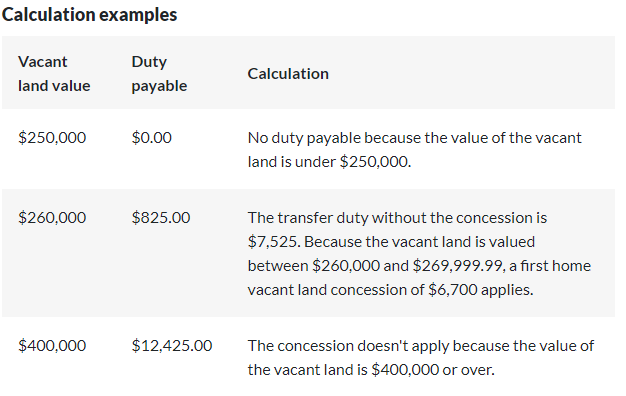

The Queensland government offer a reduction of stamp duty when you purchase a block of land through the first home vacant land concession. With this concession, you stand to save up to $7,175.

Unlike the First Home Owners Grant, you do not need to be an Australian citizen or permanent resident to receive this concession. There are however some criteria you need to meet:

FIrst Home Vacant Land Concession Eligibility

To be eligible for the FHVC you must:

- be purchasing land valued under $400,000

- have never held an interest in another residence anywhere in Australia or overseas.

- be at least 18 years of age (may be waived)

- be paying market value if the house is valued between $320,001 and $399,999. For example if you were gifted land valued at $350,000 you will not receive the concession

- build your first home on the land, move in with your belongings and live there on a daily basis within 2 years of settlement.

- only build 1 home on the land

- be sure no pre-existing buildings or parts of buildings are on the land when you buy it .

- not dispose (sell, lease or trasnfer the home to someone) before you move into your home.

- not dispose of the home within within 1 year of moving in

NOTE: If you’re buying land valued UNDER $250,000 you won’t pay any stamp dutye

Like the FHOD there are exceptions to there’s rules that might make you eligible despite not meeting all these requirements.

Can you claim the concession after you’ve built?

Yes you can! If you weren’t sure whether you were eligible or weren’t aware of the concession you can retroactively claim the concession as long as you meet the requirements.

Can you lease a room out to someone and claim the concession?

No, not until you have lived in the home for a year. After that, you can do whatever you want.

Flexible Work Landscape ?

If covid has taught us anything about where we live it’s that living near the city is becoming less essential. Having to work from home has shown us that it’s entirely possible to effectively work outside the office. Taking this into consideration when looking to buy your first home can save you a lot of money.

Work From Home – Live Further Out

Remote work is more accommodating than ever and this opens up a unique opportunity to own an affordable house without the disadvantages typically associated with outer-suburb living.

- Work from home means you can live further out from the city without having to make the commute.

- Outer Brisbane suburbs are growing! They have all the conviences you need without the high prices. Places like springfield lakes have all the nessisary ammenities right on your door step.

Work from home the new norm?

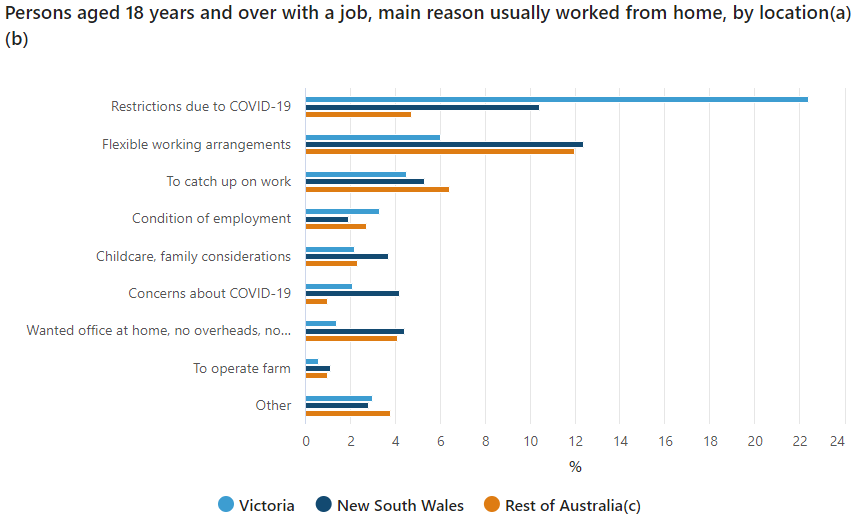

In 2021 Work from home has become far more commonplace than ever before. In February 2021 more Australias (except for in Victoria) were working from home by choice than because of covid restrictions.

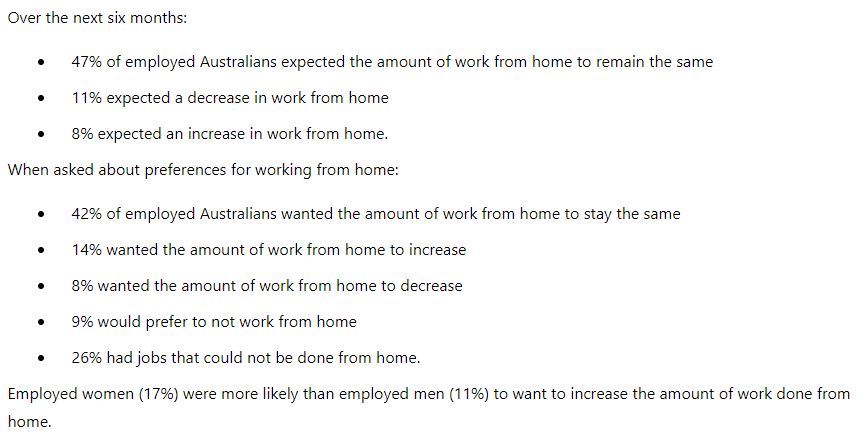

As for work from home in the future here’s what Australians are thinking.

Nearly half of Australians either expect or would prefer to continue working from home in the future. This could lead to a shift in the way we value inner-city life.

Change in lifestyle

If the trend of work from home becoming a viable long term option continues you could see inner-city living as an option but not a necessity. This would give you a lot more flexibility on where you can set up your first home.

Moving to an outer suburbs hub gives you all the convenience of living in the city without the big price tag. Moving somewhere like Springfield for example; will provide you with all the shops, restaurants, and parks that people scramble to be near in the city. Should you need to get into Brisbane it’s only 40 minutes from the local train station into the CBD or head into Ipswich in a 10 minute drive.

Looking to the future and positioning yourself to take advantage of trends can be a great way to get ahead of the curve. With outer-suburb living set to only get more expensive as these master-planned communities expand; getting in early can guarantee you a prime spot for a new way of living.

Rentvesting ?

If a change to your inner-city lifestyle isn’t for you then maybe rentvesting is. People chose to rentvest when they want to get their foot in the door of the property market while still living in a suburb they desire.

What is Rentvesting

Rentvesting is when you buy an investment property and lease it out while simultaneously living in a rental yourself. If you love where you live but can’t afford to buy a home in the area, rentvesting allows you to live where you can’t afford to buy and buy where you don’t want to live.

Why should you Rentvest?

Rentvesting allows you to reap the benefits of owning a home like capital gains while still living in your desired area. The place you’d really like to live is usually out of your budget so this alternative gives you the best of both worlds.

Rentvesting lets you buy faster

Buying a home solely as an investment takes a lot of the pressure out of building a home. For example, if your building a new house that you expect to live in everything will be important; from the garage space to the colour of the skirting board. This is not the case when building an investment property.

Knowing you won’t be living there means you can streamline the build process by sticking to the builders’ plans and not customising it for your needs. After all your not going to be living there.

Looking for a Builder in Brisbane?

There are so many building companies to choose from, and you can only pick one. Then the are council fees, deposits, hidden extras and delays… treacherous…

Lucky Buildi is here to help navigate the waters! We team up with you to get the best outcome for your build. After listening to what you want, we find a trusted builder that wants to play ball.

Give us a ring and we’ll answer all your burning questions.

No more rent, every dollar you spend on your home adds to its value.

No more rent, every dollar you spend on your home adds to its value. Money spent on rent goes into someone elses pocket and you’ll have nothing to show for it in the end.

Money spent on rent goes into someone elses pocket and you’ll have nothing to show for it in the end.

0 Comments