With constant news stories about rising property prices, it’s no wonder people are interested in purchasing land as a long-term investment. But what are the advantages and potential risks that come with land investment? Let’s take an overview of land investment and help you decide whether investing in land is a smart choice for you.

What makes land investment so appealing to investors?

Land is an appealing investment for a few key reasons. For one, until we discover something else to build on, land is always going to be in demand. This makes it a more stable and reliable option than other investments, such as buying into a business or the stock market.

Stability means less risk but also requires more patience on your part. Apart from a few extraordinary cases, you can’t expect a land investment to have the same speed of capital growth that is possible with stocks or crypto. For every person we’ve heard of getting rich off the stock market, there are plenty who haven’t, because along with the potential for stocks to skyrocket is the chance that they’ll crash overnight. This is much less likely to happen with land investment making it a more stable investment.

What are the different types of land investment opportunities available?

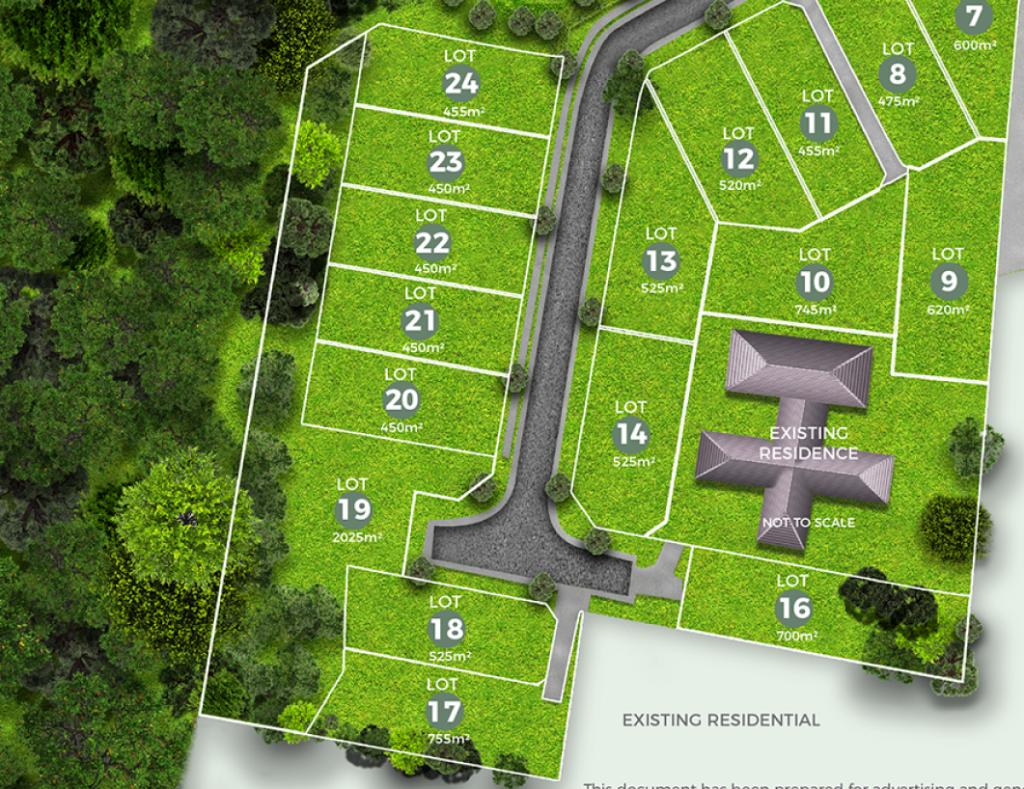

Residential Property: This is a property that can be used for homes, rentals or inhabitable buildings.

Commercial Property: This is a property designed for a business or commercial venture.

Agricultural land: Land which can be used for growing crops, raising livestock or other agricultural purposes.

Vacant land: Any block of land that is yet to have anything built upon it.

The importance of conducting due diligence when buying land for an investment

It’s nearly impossible to tell with the naked eye the soil condition of most blocks of land and this is why it’s crucial to perform your due diligence. Some of the key steps you should take with any block of land include:

Soil testing: A soil test is an essential step in construction as it is the main method to reveal the condition of the soil. This reveals the stability of the ground which is important if you don’t perform one before your block of land, your builder will before starting any construction work.

Flood zones: Along with performing a soil test, be sure to check whether the block of land is in a bushfire or flood zone. If it not only increases your bushfire and flood risk, it’ll considerably add to the price of your insurance and make the land difficult to sell in the future to potential buyers, which is a huge problem for an investment property.

Local council regulations: Check with your local council to make sure you’ll be able to achieve what you plan to with your land. It’d be incredibly frustrating to find this out after you bought the block.

What are the different financing options for buying a block of land for investment?

The most common loan used to purchase land is a land loan (or vacant land loan). These loans are specifically designed to help cover the cost of the block of land rather than the eventual construction. Some key factors that will help your chances of getting approval include:

- Location of your land: This helps determine the value of the block you’re buying.

- Whether the land is registered or not: Loaners won’t approve a loan for unregistered land.

- Proposed use of the land: This helps the loaner determine the odds of you being able to pay them back.

- Size of the land: this will determine how much you need to borrow

Different types of loans will better suit different situations. Loans can come with a fixed rate, variable rate or split rate, and it’s important you have a thorough understanding of the proposed loan you’re considering. We recommend having an in-depth discussion with your financial advisor about the best loan for your situation.

What legal and regulatory considerations should I be aware of before buying a block of land for investment?

No matter where you are building in Australia, it is essential you or your builder are aware of the regulations and rules laid out in the National Construction Code. This outlines the laws you need to adhere to in order to build a legal and safe building. There have been some updates to this code recently, so be sure your builder is aware of this.

Beyond the code, you need to be aware of the laws within your local area. There are two key factors you’ll need to investigate. First, are any regulations put in place by your local council? These are most likely to be health and safety and restrictions on what you’re allowed to build. Second, are any covenants put in place by land developers you may have bought from? The latter may dictate what materials you can build with, the size of your building and other details regarding the look of your new home.

What are the benefits of buying land for investment?

There are many potential benefits to purchasing a block of land for investment purposes including:

- It has a lower purchase price than an investment property, which means you may be able to borrow less and pay a lower deposit.

- Stamp duty is much lower than buying an existing house

- There’s less competition when it comes to buying land, so your chances of grabbing a bargain are higher.

- Buying land allows you to stagger costs, whereas buying a house means all costs come at once.

- Allows you to build a

- No repair bills and low ongoing maintenance costs on vacant land.

- Lower insurance costs

- Potential for rapid value increase if you purchase in the right place.

What are the risks involved when buying a block of land for investment?

No investment is completely risk-proof and buying land is no exception. Here are some of the potential downsides and risks you need to be aware of.

- Banks may consider your purchase as a speculative investment, which means they’ll be more reluctant to loan you money. This will depend on where you buy land.

- It’s difficult to turn an income from vacant land the way you can with a house (renting, etc).

- undeveloped land may not appreciate in value as quickly as a house.

- Though there is less maintenance with a vacant block of land, there will be the cost of mowing undeveloped land.

- When you sell your block, you may have to pay capital gains tax.

- Your local council regulations may stipulate you need to build a fence

- You’ll need public liability insurance to protect against anyone who hurts themselves on your block

- There’s always a risk your land will depreciate in value. Depending on your financial situation this could be a minor setback or a crippling blow.

What do you need to consider when building on the land?

What’s your ultimate goal: Are you looking to build a property you can rent out for years to come, or are you looking to build a house you can sell? Knowing your end goal allows you to be more specific in your steps.

Consider your market: Where your building plays a huge role in who you’ll be likely selling to. Young professionals have different requirements than families or retirees.

Choose functionality over aesthetics: If you’re building a property to rent, your focus is on ensuring all your fixtures and layouts are functional. Go for a universal, blank canvas that your tenants can add their own touches to.

How can land help generate returns over time?

There are a few ways to make some money with your block of land including:

- Build a property and rent it out to tenants.

- Build a house and sell it in the future.

- If you own agricultural land, you can rent it out to farmers.

- You may be able to rent your land to a business for commercial purposes.

- Over time, your land will hopefully increase in value.

- You could turn a vacant lot into a car park and rent it to nearby businesses.

What are some potential exit strategies for land investments?

With any investment, it’s essential to have an end goal in mind. Having a see-what-happens approach is a luxury few can afford to gamble with and it’s best to have both an ultimate goal and a back-up plan should things go south. Some potential exit strategies include:

- Sell to pay off your debts: Most of us have a mortgage, student loans or other debts we’d like to pay off. A goal many property investors aim for is to make a profit that can pay off or put a substantial dent in what they owe.

- Build a house and rent: The rental market is booming in areas across Australia, so an ideal use for your land would be to build a home you can rent. This will create an income, and eventually, you could sell the home. Research the rental market in the area you’re building in so you have an idea of who to target and an appropriate amount of rent to ask for.

- Pass on to family: Some people with a property portfolio choose to give or sell some of their investment to their children or family members as a nest egg. The one thing to keep in mind with this is you can’t let your love blind you. Your children won’t have the same amount of experience with managing property as you and may need some guidance at first. On the other hand, you need to accept that through no fault of their own, your children may experience difficulties with the land you didn’t have to.

You may decide to adapt or change your exit plan down the line, but having a finishing line in mind will help you stay on track and be less likely to become complacent.

0 Comments