The Sunshine Coast’s one of the biggest growth areas in South East Queensland, experiencing a strong increase of 25% over the past year. With a steady local economy and plenty of great areas to raise a family, it’s not hard to see why the relaxed vibe of the Sunshine Coast is attracting home buyers from all over the country. In this article, we’ll be looking at some of the Sunshine Coast’s best investment suburbs. The Sunshine Coast has a tight rental market and is in high demand, so with a little know-how and research, you should be able to make a good investment in the Sunshine Coast. So, for anyone looking to invest in the Sunshine Coast, Queensland or want to make the most of Sunshine Coast Lifestyle, you’re in the right place.

Why get into the Sunshine Coast Property Market

Along with Brisbane and the Gold Coast, the Sunshine Coast is one of the most promising property markets in South East Queensland and here are just some of the reasons why:

- The area is experiencing a boom.

- Vacancy rates are tightening.

- The population and the demand for the property are growing.

- A wide variety of suburbs from upmarket to coastal to rural.

- A well-regarded area for raising a family.

- Close to Brisbane so you can visit the big city without the hustle and bustle of living there.

- Natural attractions like the beaches and bushland areas are considered some of the best in the world.

Quick Tips for Investment Property

While investing in property can seem straightforward at first, it doesn’t take long to realise how complicated and overwhelming it can all feel. We’re going to be honest and say there’s no such thing as a hot spot or a sure thing when it comes to investment properties, however, savvy investors often look for a few things when looking to invest. Here are a few tips to get you started on your investment journey.

Know your budget

This is one of the most important steps you can take because a huge proportion of problems in the building industry come down to money. Be honest and realistic with yourself about your financial situation and what you can afford, to avoid problems down the line. In the same vein, we recommend you apply for a pre-approval of your investment loan from your bank. Talk to your relevant credit provider and what home loans you’re eligible for.

While it’s not necessary to be debt free to buy an investment property, you’ll want them to be under control and manageable. At the very least, make sure your financial situation can support an investment property.

Know What You’re Looking for

Before you start visiting potential investment properties, consider what you hope to achieve with your investment property. Having clear goals and plans can help you stay on track and avoid being swayed when caught up in the moment.

Be aware of ongoing fees

When working if you can afford an investment property, you need to remember that there will be ongoing, monthly fees, including:

- council and water rates

- building insurance

- landlord insurance

- body corporate fees

- land tax

- property management fees (if you use an agent)

- repairs and maintenance costs

Be realistic with your goals

We’d all like to end up being millionaires, but you may need to be realistic about what you hope to achieve with your investment property. Property can be a fantastic investment, however, it requires a lot of work, time and effort. We’ve all heard stories of someone who bought a beachside shack in the 60s for a couple of thousand only for it to be now worth millions, but expecting this to happen is just setting yourself up for disappointment. You’re better to make sure your investment brings in a steady income over time than take a wild swing and hope for an immediate, big payout. Base your goals on research and facts, and you’re less likely to be disappointed and more likely to be successful.

Consider saving money through DIY

For anyone buying a pre-existing house, a lot of your expenses will go into renovation and labour. Hiring labour isn’t cheap, especially when you need to hire different tradesmen for different jobs, so the more renovations you can do yourself, the more money you’ll save.

How good an idea this is will depend a lot on your own level of skill. If you’re not a natural with your hands, you might end up doing more harm than good. Also, try not to overestimate your ability, as it’ll be costly (and a little embarrassing) when you have to call someone out to fix up your mistakes. Finally, keep in mind there are things you can’t legally do yourself unless you’re qualified, like most electrical work.

Liveable could be more valuable than luxury

When looking to attract potential tenants, a liveable property is going to cast a much bigger net than a luxurious property will. Most renters don’t have endless amounts of cash to throw around (hence why they’re renting), so they’re more likely to be prioritising budget and comfort over luxury and extras.

This approach also works in your favour as well as a landlord. When renovating, try to go for practical, durable materials and fixtures over anything too fancy. Also be punctual with maintenance, as most problems are better solved sooner rather than later. Thinking long-term (good paintwork, durable fixtures, excellent ventilation in the bathroom to avoid mould) will not only make life easier for your tenants, but it’ll also help your investment property stay in great in shape.

Emotions aren’t always reliable when it comes to investment

The heart wants what the heart wants, but an investment property isn’t a romance, it’s a business. Even the most logistic of us can get swept up in emotions when looking at buying houses. We’re not saying you can’t you can’t get excited and happy about the process, however, it’s important to apply logic and strategy to all your choices. The best approach is to see the sum of the parts and weigh them up. For example, is that amazing view worth having to rebuild the entire house? Is the mould problem fixable or is it worse than you think? Does the potential demand in this suburb warrant the price it’ll cost to get the land in the first place?

This is where having a plan earlier on can really help. Having goals and a plan of attack gives you something to refer back to and can bring you back on track when things become overwhelming.

Credit Provider

Unless you’re in a very fortunate position, you’re probably going to have to borrow some money to get started with your investment property. You’ll need to speak to your bank or credit provider and find out what you’re able to borrow and make your investment plans accordingly.

Be aware you may have to deal with vacancy

It’s impossible to guarantee anything when it comes to property investment, and that includes when you’ll have a tenant. There will be times between tenants when no one is occupying your property and therefore you won’t be making any profit, however, this is just part of the game.

People will come and go for a variety of reasons that have nothing to do with you or the property. That being said, if you are sure to meet your duties as a landlord, you can avoid giving quality tenants extra incentive to leave.

Along a similar train of thought, if you’re planning to sell, be aware that it could take a while for you find a buyer or you could have multiple offers in a short span of time. It’s best to be prepared for either situation.

Top Suburbs to Invest In

#1 Nambour

A city with a small town feel, Nambour has started showing up on a lot of investors’ radars lately. In recent years, Nambour real estate has seen increased demand, especially in the last decade or so. Not far from many other areas in the Sunshine Coast area while still offering its own attractions, including beautiful landscapes, shopping, medical facilities, schools, sporting facilities and public transport. There are properties here for more affordable prices than you would find in other suburbs on the Sunshine Coast, and depending on where you buy, you might even get more land for your money. It’s also close to smaller towns such as Woombye and Palmview.

It has an older population, with a lot of retirees but is also great for families.

Population: 19,576

Median House Price: $650,000 (35.4%) 426,000 (37.4%)

Median Rent: $510 pw (house) $400pw (unit)

Rental Yield: 4.7% 5.5%

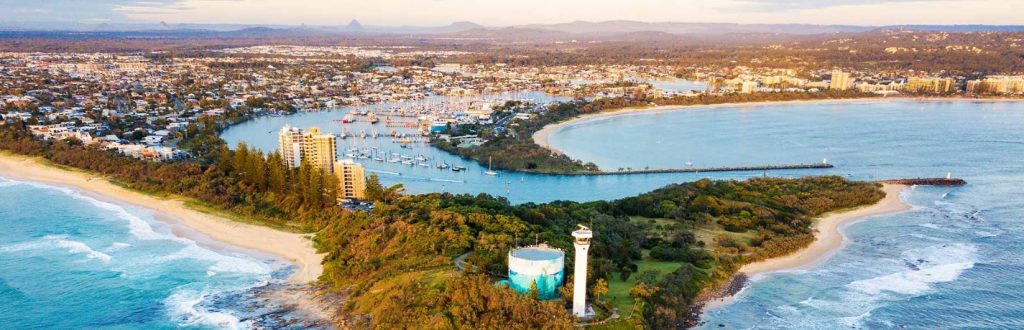

#2 Caloundra

The very south of the Sunshine Coast, Caloundra is a seaside city located about an hour north of Brisbane. It’s a popular area due to its proximity to the beach and its relaxed atmosphere. Caloundra is the name of both a region and a suburb within that region, so keep this in mind when looking at properties. With King Beach, Golden Beach, Shelley Beach and Moffatt Beach all in the vicinity (not to mention Bribie Island is close by), Caloundra is perfect for anyone looking at for the coastal vibe and could be a great place to rent to holidaymakers or permanent residents.

Population: 51,095 (region)

Median House Price: $907,500 (37.0%)

Median Unit Price: $725,000 (37.4%)

Rent: $570pw (house) $495pw (unit)

Average Rental Yield: 3.6% (house) 4.2% (unit)

#3 Palmview

Palmview has a range of display homes to view in the Harmony Estate. With plenty of green surroundings and only ten minutes away from Mooloolaba beach, Palmview offers a range of incentives to enjoy the outdoors. Close proximity to some local attractions such as Aussie World and the Ettamogah Pub, it also is a short drive away from the University of the Sunshine Coast and many of the Sunshine Coast’s other suburbs, including Maroochydore, Mooloolaba and Caloundra.

It’s also the home of the Harmony Estate, a development project that has proved to be very popular, showing the area has good signs of capital growth.

Population: 893

Median House Price: $820,000 (31.7%)

Median Rent: $600pw

Rental Yield: 4.5%

#4 Mountain Creek

Mountain Creek is located near Buderim and Sippy Downs, and about 15 minutes from Maroochydore and Mooloolaba. A nice leafy area with its own shopping centre, it is also close to Buderim’s many cafes if you’re ever after a coffee. Close to the University of the Sunshine Coast, it is an ideal place to rent to students and uni staff as well as being a nice area to raise a family.

Median House Price: $899,500

Unit price: $572,500

Rent: $650pw $530pw

Average Rental Yield: 4.1% 5.1%

In close proximity for Sunshine Coast University Hospital

#5 Coolum Beach

Located on the Northern side of the Sunshine Coast, Coolum has an especially strong market for apartments with unit prices skyrocketing by 40% in value. It’s a more laidback alternative to Noosa, with a less trendy vibe and more relaxed attitude. Due to it being less well-known, it has fewer tourists than Noosa or Mooloolaba, which might be attractive to potential buyers and renters. The area has a great, beachside town atmosphere and is perfect for anyone who loves swimming, surfing or just a day at the beach. Coolum Beach has in the past been named one of Queensland’s best beaches and has sound beautiful hinterland surroundings, including the famous Mt Coolum.

Median House Price: $955,500

Rental Yield: 3.8%

Median House Price: $955,500 for houses and $635,000 for units

Average Rental Yield: 3.8% for houses

#6 Mooloolaba

One of the most popular tourist areas on the Sunshine Coast, with a surf beach as well. Bordering other suburbs such as Alexandra Headland, offering plenty of beautiful beaches within a short distance. Mooloolaba beach is constantly ranked as one of the finest in the world, so it’s no wonder people are flocking to move there.

Median house prices in Mooloolaba: $1,115,000 for houses and $565,000 for units

Average rental yield in Mooloolaba: 3.0% for houses and 4.3% for units

5-year compound growth rate in Mooloolaba: 10.8% for houses and 7.7% for units

#7 Peregian Springs

Located to the south of Noosa, Peregian Springs is a popular area near both the beach and hinterlands. The overall look of the houses in the area is contemporary and the suburb, in general, has a good reputation for being tidy, safe, and family-friendly. House prices here aren’t cheap, with the chances of you spending a million is pretty high. However, these prices have risen by 33% in the last year, so it’s a promising sign for any investment you make.

Median House Price: $1,000,000 and $629,000 for units.

Rent: $690 (house) $400 (unit)

Rental yield: 3.58%

#8 Gympie

Technically part of the Wide Bay Region, Gympie is an affordable option for anyone looking to invest in the country. A small city with a country town vibe, Gympie is surrounded by beautiful landscape and plenty of history. Part of its appeal is its relative affordability compared to a lot of suburbs in the Sunshine Coast area. With its own hospital, plenty of schools and shopping, Gympie has a lot to offer. The drawback is that it is at least a 45 minutes drive to the Sunshine Coast and the quieter life won’t be to everyone’s taste, however, there are still opportunities for tenants and buyers in the Gympie area.

Median House Price: $355,000 and 289,750 for units

Average rental yield in Gympie: 5.1% for houses and 4.7% for units.

#9 Noosaville

Noosaville is a town and suburb in the Noosa Shire, known for its beautiful beaches, surroundings and trendy restaurants, shops and cafes. Great for those looking for luxury living and popular with retirees, families and interstate buyers.

Population: 8,129

Median House Price: $1,650,000 for houses, and 800,00 for units.

Weekly Rent: $850 (house) $580 (unit)

Median Rental yield: 2.67% (house) 3.77% (unit)

#10 Maroochydore

One of the central hubs of the Sunshine Coast, Maroochydore offers a lot of the defining features people think of when they think of the Sunshine Coast. Close to Sunshine Plaza and other shopping centres (including Sunshine Plaza. Easy access to public transport, hospitals, beaches and a variety of attractions.

Median house price: $795,000

Rental: 3.8% houses

#11 Pacific Paradise

Pacific Paradise is a Maroochydore Suburb with a family-oriented community. It has a strong rental community, with a lot of Air BnB and a steady tourist market. An ideal area for beach lovers, it is less well known than other areas and therefore somewhat of a hidden gem.

Median Price: $650,000

Rent Price: $550

Rental Yield: 4.4%

#12 Sunshine Beach

Sunshine Beach is a coastal town in the Noosa Shire which used to be considered one of the region’s best-kept secrets. One of the most expensive suburbs in Queensland, it’s a tough market to enter, but your investment is likely to pay off.

Population: 2,460 people

Rent price: $850

Rental Yield: 1.60%

Need help finding the right design and builder for you?

At Buildi, we help you find the right builder, save time, reduce stress and stay on budget.

How We Can Help You

Building a home is one of the biggest decisions you’ll ever make. At Buildi, we’ll be there throughout the entire building process, guiding you step by step so you can avoid any pitfalls. We will help you by following these steps.

- Free Consultation – We will sit with you to understand what you are looking to accomplish.

- Due Diligence – We work with you to ensure you’re buying the right block of land at the right price without hidden problems.

- Builders tender – We will take your requirements out to the market of builders, and they will bid to win your business.

- Present solutions – We will compile the top 3 options and present you with a comprehensive proposal on builders’ strengths & weaknesses along with prices and specifications.

- Contract Signing – We will work with you and your selected builder to ensure there is full transparency in what you are entering into.

- Building your home – We work closely with the builder to ensure all service levels are met and your project is on schedule.

0 Comments